Goods. A Relationship Manager is someone who adds value to the bank and the customers.

Filing Of Gst Return Video Guide Youtube

GUIDE ON GOVERNMENT LOCAL AUTHORITY AND STATUTORY BODY.

. 2021 ITRF Submission Dateline. Sales and Service Tax SST in Malaysia. Jpgpnggif and pdf ii.

Malaysia has a well-developed infrastructure. With expertise and experience you can expect to get even higher salaries and better career growth. Malaysia Office Location M1-7-7 8trium Tower Office Jalan Cempaka SD125 PJU 9 Bandar Sri Damansara 52200 Petaling Jaya Selangor Singapore Office Location 60 Paya Lebar Road 12-26 Paya Lebar Square Singapore 409051.

The World Bank ranked Malaysia as the 6 th friendliest country in the world to do business according to its 2014 report. Real Property Gains Tax RPGT. Malaysia has a strong educated workforce and English is widely used as a business language.

Individual who are not citizens of Malaysia. A registered person is required to. The programme is aimed to start a career as a Relationship Manager at ICICI Bank which is The Best Company to Work for in the BFSI sector 4 th rank in Top 10 companies across all sectors as per the survey done by Business Today in 2020.

How much salary can a GST practitioner expect. A GST Practitioner can earn anywhere from 3lacs- 65 lacs per annum. An assured opportunity to get job at ICICI Bank.

Format of the attachment. Submission of GST returns according to the taxable period granted the payment of. Malaysia Office Location Tel 603 6262 8468 Singapore Office Location.

The Ministry of Finance MoF announced that Sales and Service Tax SST which administered by the Royal Malaysian Customs Department RMCD will come into effect in Malaysia on 1 September 2018. 2021 ITRF Submission Dateline. The move of scrapping the 6 GST has paved the way for the re-introduction of SST 20 which will come.

Malaysia GST Types of Supply Criteria for GST Registration for Business. Through mail or fax to any nearest LHDN office. Enclose completed CP600B form to update email address if the applicant email is different from the email address that already registered with the IRB.

How to Pay Income Tax and RPGT. Remisi Penalti GagalLewat Bayar Dibawah Akta GST 2014. More 41.

Jabatan Kastam Diraja Malaysia Kompleks. SST-02 SST-02A Return Manual Submission More 52 28102020 Sales Tax Service Tax Guide on Return Payment More 53 14102020. In Malaysia a person who is registered under the Goods and Services Tax Act 2014 is known as a registered person.

Malaysia beat out countries like Australia and the United Kingdom to claim this spot. More 40 09042021 Report To Be Prepared For Exemption under AMES. The sole director of a freight forwarding company was jailed and fined more than S4 million on Thursday Jun 23 for evading Goods and Services Tax GST and falsifying documents.

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Malaysia Accounting Software Best Accounting Software Accounting Software Accounting

Gst Compensation Some States May Get Relief Package A2z Taxcorp Llp

Gst Change Of Address A Quick And Easy Online Process Ebizfiling

Filing Of Gst Return Video Guide Youtube

Documents And Procedures For Exporters Under Gst

Basics Of Gst Tips To Prepare Gst Tax Invoice

Excel Tutorial Formulas For Calculating Gst At 15 Youtube

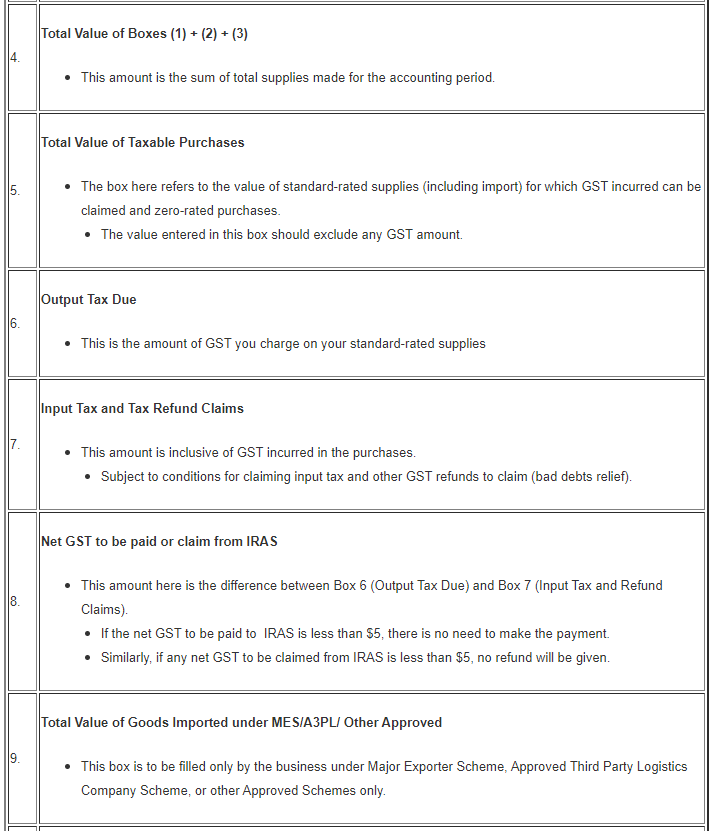

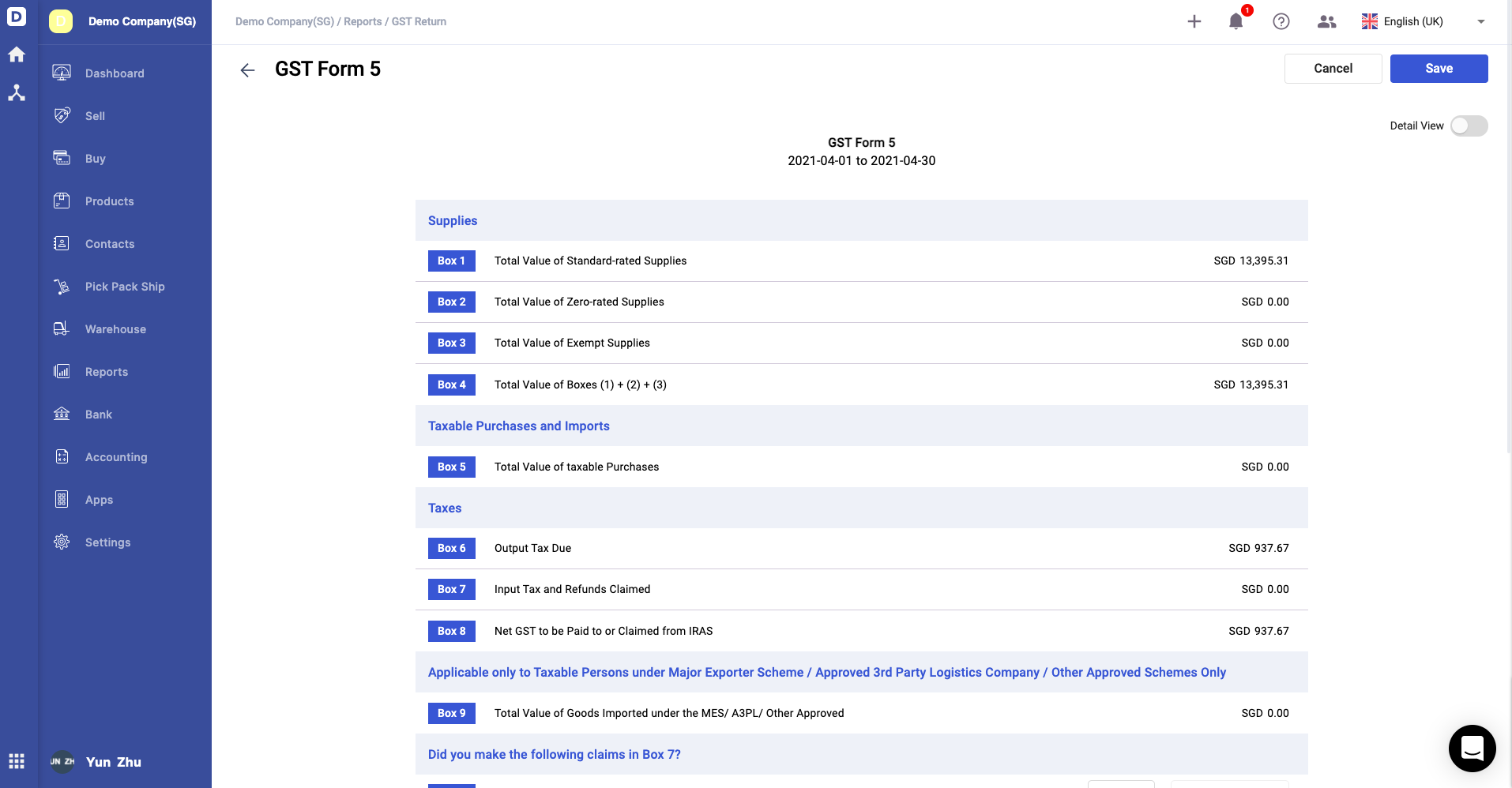

Introducing Our Latest Enhancements To The Singapore Gst F5 Return Experience Xero Blog

All You Need To Know About Gst Reconciliation In Singapore Enterslice

Mortgage Refinance Malaysia Instant Loans Mortgage Loans Cash Advance Loans

Maharashtra Introduces 31 Gst Reforms For Ease Of Doing Business Read More Https Bit Ly 2icmxoq Gst Gst Business Read Goods And Services Digital Signature

Import Goods That Have Gst Finance Dynamics 365 Microsoft Docs

Import Goods That Have Gst Finance Dynamics 365 Microsoft Docs

Introducing Our Latest Enhancements To The Singapore Gst F5 Return Experience Xero Blog

Introducing Our Latest Enhancements To The Singapore Gst F5 Return Experience Xero Blog